Celebrate 529 College Savings Plan Day

Did you know May 29 (5/29) is recognized as National 529 College Savings Plan Day? Well, now you do!

There are many ways to save and invest for education, with some accounts offering more tax advantages than others. To better understand the differences between each education savings plan and see what might be the best fit for you, let’s take a closer look at a popular option – a 529 College Savings Plan.

529 Plan

49/50 states offer a 529 Plan (Wyoming does not). Some states offer multiple types of plans (pre-paid tuition plan, or investment plan) and multiple investment providers and options. The 529 Plan has advantages much like the Roth IRA and Education Savings Account as long as distributions are for qualified education expenses, which include tuition, fees, books, and sometimes room and board. Distributions not used for these expenses will have tax implications on the growth of the funds (no the basis, or amount contributed) and a 10% penalty tax.

Pros:

- Over 100 plans available to choose from.

- Contributions vary per state, but limits can run as high as $300,000 per account.

- Beneficiaries can be named in multiple accounts.

- Parents, grandparents, and friends can all contribute to the account.

- Beginning in 2018, up to $10,000 per year can be used for K-12 education expenses.

- No age limit for starting an account or distributing from an account.

- No income limits for contributing to the account.

Cons:

- Less investment flexibility due to investment tracks (investments can only be changed once a year).

- Some plans have higher than average fees that affect investment return.

IMPORTANT:

Considering a college savings account requires quite a bit of strategy regarding taxes, investments, generational wealth transfer, financial aid, and other areas of financial planning. There are a lot of rules regarding these two account types that are not discussed in the above synopsis. It is very important that you meet with a qualified financial planner to make sure you are maximizing the potential benefit.

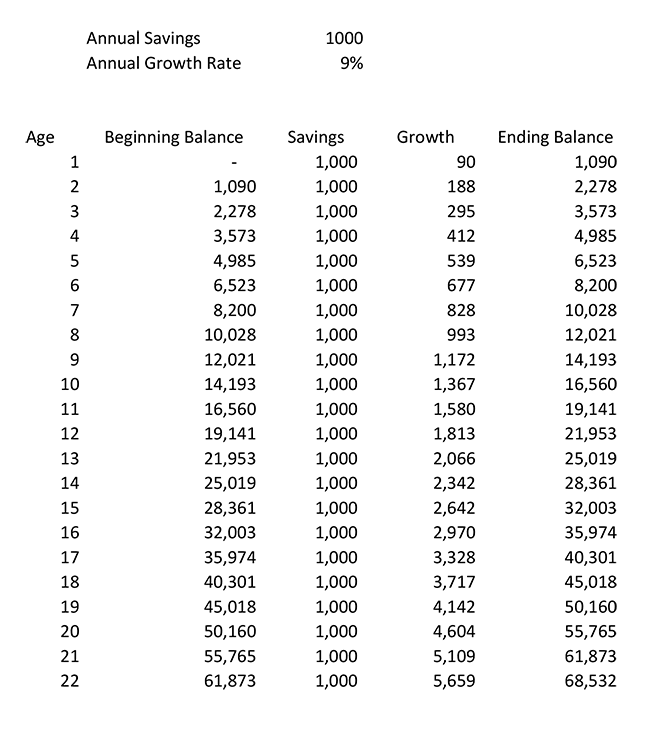

Table 1

This table illustrates a college savings plan of $1,000 per year in either an ESA or a 529 Plan.

Sources:

savingforcollege.com, nitrocollege.com & daveramsey.com