Market Commentary: Q1 2025

The first quarter of 2025 started strong for U.S. stocks but ended with a decline, underperforming global markets. Investors faced uncertainty around economic conditions, competition in the AI sector, and potential tariff impacts under the new presidential administration. While the S&P 500 hit record highs early in the quarter, it was down for the year by late March.

After cutting rates by a full percentage point in 2024, the Federal Reserve held interest rates steady in the 4.25%–4.5% range, citing inflation concerns and economic uncertainty. Meanwhile, international markets outpaced U.S. stocks—an uncommon trend in recent years—highlighting the benefits of global diversification. In the bond market, U.S. Treasury prices rose, bringing the 10-year yield to just below 4.5%.

Key Market Movers

Tariffs & Economic Policy

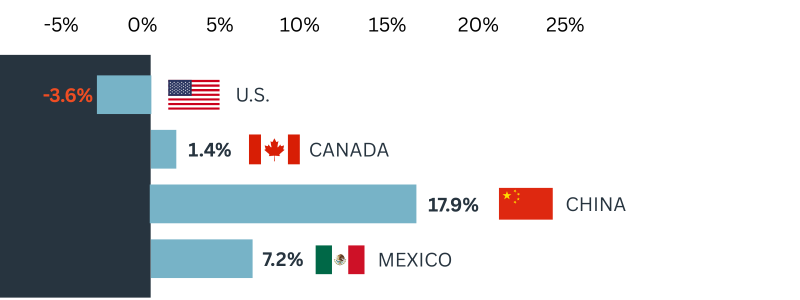

The threat of tariffs continues to cast a shadow over markets. While tariffs on China, Canada, and Mexico are already in place. Despite this, markets in these affected countries have posted gains for the year, while U.S. stocks have struggled (see Exhibit 1).

Exhibit 1

Performance Review: index returns (in local currency), January 1, 2025 – March 21, 2025

History suggests that tariff activity doesn’t always dictate market performance. During President Donald Trump’s first term, both U.S. and Chinese markets outperformed the MSCI World ex USA Index despite ongoing trade tensions. Given the unpredictable market responses to policy changes, maintaining a well-diversified portfolio remains essential.

Inflation & Unemployment

Inflation remains elevated, with core consumer prices rising 3.1% year-over-year in February—still above the Fed’s 2% target. Meanwhile, the unemployment rate inched up to 4.1%, adding to economic uncertainty. These factors reinforce the Fed’s cautious approach to interest rates.

AI Sector Volatility

A major shakeup in the AI space rattled markets when Chinese firm DeepSeek developed a competitive AI model with significantly lower investment than U.S. counterparts. This news contributed to a $600 billion single-day market loss for NVIDIA, highlighting the risks of concentrated investments—even in high-growth sectors.

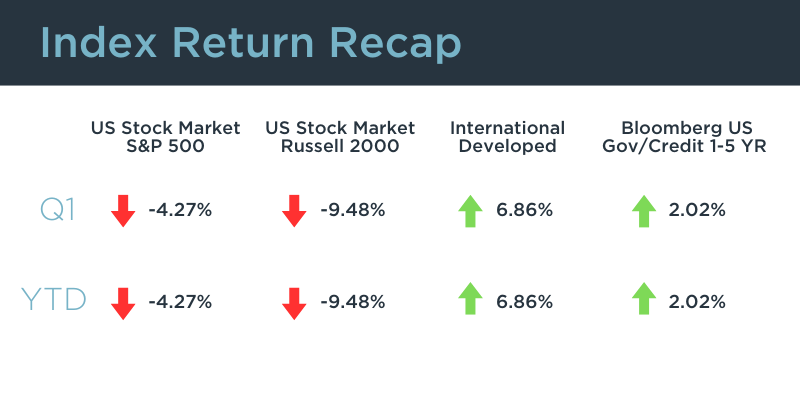

Market Summary

Quarter 1 & Year-to-Date 2025 Index Returns (January 1, 2025 – March 31, 2025)

Keeping Volatility in Perspective

With ongoing uncertainty around tariff policy and continued market volatility, many investors are feeling the impact of short-term swings. Market swings serve as a reminder that volatility is a normal part of investing. While downturns can be unsettling, they shouldn’t be unexpected. Rather than focusing on short-term market movements, investors are better served by staying focused on long-term goals. A disciplined investment approach ensures that temporary declines don’t derail financial progress.

Takeaways

- Diversification Matters: With international markets outperforming the U.S., a globally diversified portfolio can help manage risk.

- Market Volatility is Normal: Even strong sectors like AI can experience setbacks, emphasizing the importance of a long-term perspective.

- Interest Rates & Inflation: The Fed’s stance on rates will continue to shape market trends. Monitoring inflation and employment data remains crucial.

Invest Where it Really Counts

As we venture into the second quarter of 2025, it’s natural to wonder how tariffs, policy changes, and evolving markets might shape the future. Our team is prepared to navigate you through any volatility that may arise, and we remain grounded in a disciplined, long-term investment philosophy. We thank you for trusting Petersen Hastings Wealth Advisors to help you discover where you’re most invested in life and build you the financial freedom to live it.