Market Commentary Q4 2025

As the calendar turns on another year, the fourth quarter of 2025 offered a fitting conclusion to a market cycle shaped by patience and progress. While headlines shifted throughout the year, long-term investors were rewarded for staying the course. As we review the fourth quarter and reflect on the year behind us, the markets once again demonstrated that consistency and perspective remain powerful tools.

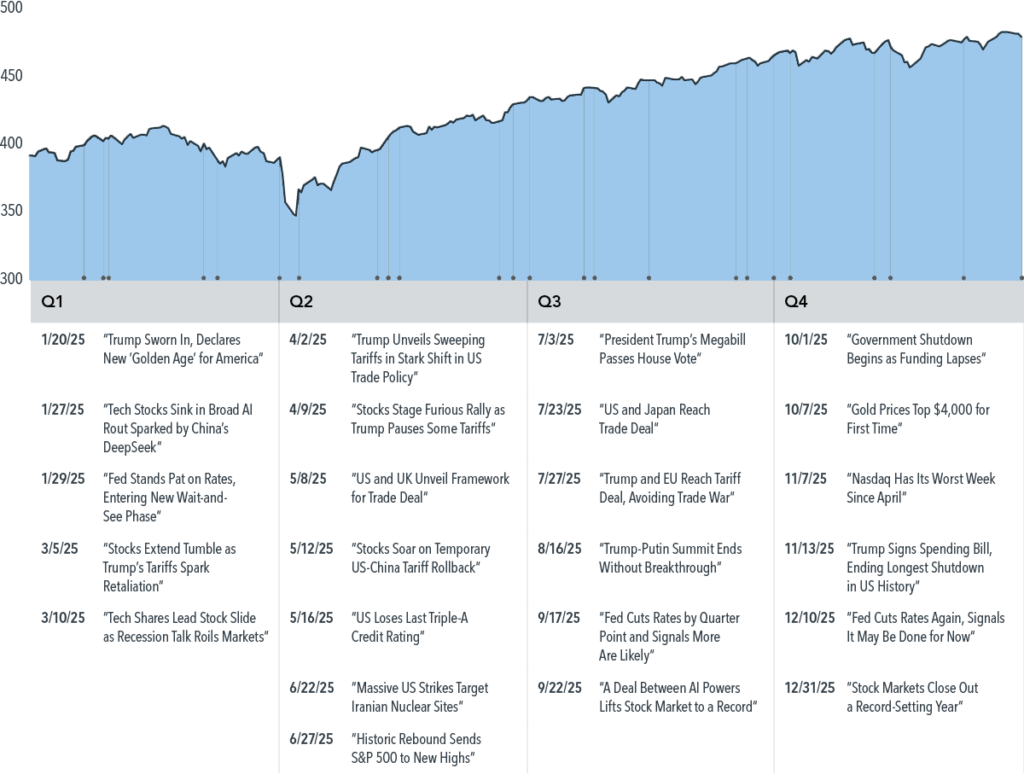

U.S. stocks recorded their third consecutive year of double-digit returns, despite a year filled with shifting headlines. The S&P 500 reached record highs early in the year, experienced a pullback in the spring, and then rebounded to new highs in the fall before settling near record levels by year-end. For the full year, the index gained nearly 18%, while the tech-heavy Nasdaq advanced over 20%, reflecting continued strength in innovation-driven sectors.

Quarterly & Year-End Recap

The final quarter of 2025 reflected many of the themes that shaped the year as a whole. Markets continued to move forward despite persistent uncertainty around inflation, interest rates, trade policy, and political developments.

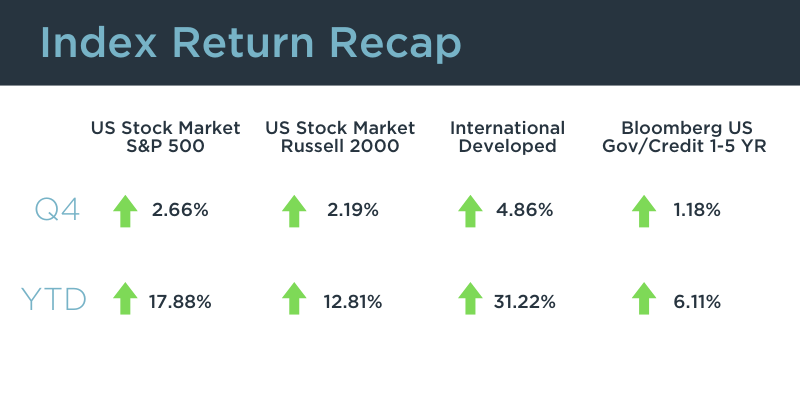

The Federal Reserve cut interest rates three times in 2025, including twice during the fourth quarter, bringing its policy rate to the lowest level in three years (3.5% to 3.75%). While inflation remained above the Fed’s long-term target, easing price pressures and a gradually cooling labor market led policymakers to focus on supporting economic stability.

Importantly, changes in Fed policy did not always move in lockstep with longer-term interest rates. For example, the 10-year Treasury yield declined over the year, helping support both stock and bond markets – a reminder that markets respond to a wide range of forces, not just headline policy decisions.

Corporate fundamentals remained resilient. Earnings held up well across many sectors, supported by steady consumer spending, improving global trade conditions, and ongoing advancements in technology and artificial intelligence. While some high-profile technology stocks experienced periods of volatility, diversified portfolios continued to benefit from innovation spreading across a broad range of industries.

Global markets also played an important role in 2025 (See Exhibit 1). International and emerging-market equities outperformed U.S. stocks for the year, highlighting the value of global diversification. Bonds delivered positive returns as well, helping provide balance during periods of equity market volatility.

EXHIBIT 1

Uphill Climb – MSCI All Country World Index (net) in 2025

Perspective Matters

Despite strong market performance, investor confidence remained cautious for much of the year. Ongoing concerns around inflation, trade policy, geopolitical events, and political uncertainty weighed on sentiment, even as markets continued to move higher.

This disconnect between headlines and results is not unusual. History shows that markets have advanced through periods of uncertainty and disruption time and again. Investors who maintain perspective and stay focused on long-term goals, rather than reacting to short-term noise, have often been better positioned for success.

Market Summary

Quarter 4 (October 1, 2025 – December 31, 2025) & Year-to-Date 2025 Index Returns

Our Commitment to You

At Petersen Hastings Wealth Advisors, our focus remains on helping you invest with purpose, perspective, and confidence. Behind every portfolio is a unique set of goals, from supporting family and community to building a lasting legacy. While market headlines will continue to change, our disciplined, long-term approach is designed to help you stay focused on what matters most.

Thank you for entrusting us to guide your financial journey. If you’d like to review your plan or talk through what lies ahead in 2026, our team is here to help. As always, we appreciate your continued trust and the referrals of those you care about.