College Education Savings Plans (ESA vs. 529)

Americans now owe more than $1.53 trillion in student loan debt. College debt burden is drowning many of our young people who will have trouble meeting their financial responsibilities as the enter the work force. Although the average student loan has a term of 10 years to be paid off, according to Nitro.com, the repayment timetable for four-year degree holders takes an average of 19.7 years with an average loan payment of $393/month.

This massive debt could be avoided by better planning. The key – as in most all types of investing – is to start as early as possible to let the compounding rates of return work to grow the account. There are many ways to save and invest for education, with some accounts offering more tax advantages than others. To better understand the differences between each education savings plan and see what might be the best fit for you, let’s take a closer look at two popular options – Education Savings Accounts (ESA) and a 529 Plan.

Education Savings Account (ESA) or Coverdell Education Savings Account

This account type is much like a ROTH IRA. Investors contribute money into the account, and the interest, dividends, and capital appreciation grow tax free as long as the student makes distributions for qualified education expenses. These expenses are generally tuition, books, fees, and sometimes room and board. Expenses can also be used for private primary and secondary education as well. If the money is distributed for non-qualified education expenses, then there will be taxes on the growth, and a 10% penalty tax. Qualified education expenses are not included in the parent or student’s income.

Pros:

- Fairly easy to get started at most brokerage firms and mutual fund companies.

- Investment flexibility.

- Qualified withdrawals cover grades K through 12, as well as college and graduate school.

- Parents, grandparents, and friends can all contribute to the account.

- Account can be transferred to a related beneficiary if the beneficiary does not use the account.

Cons:

- Eligibility for making contributions phases out once adjusted gross income (AGI) exceeds $110,000 (or $220,000 if you’re married and filing a joint return).

- Beneficiary must be under 18 to receive contributions.

- Beneficiary can only accept $2,000 in contributions per year.

- Beneficiary must make all withdrawals prior to turning 30.

529 Plan

49/50 states offer a 529 Plan (Wyoming does not). Some states offer multiple types of plans (pre-paid tuition plan, or investment plan) and multiple investment providers and options. The 529 Plan has tax advantages much like the ROTH IRA and Education Savings Account as long as distributions are for qualified education expenses, which include tuition, fees, books, and sometimes room and board. Distributions not used for these expenses will have tax implications on the growth of the funds (not the basis, or amount contributed) and a 10% penalty tax.

Pros:

- Over 100 plans available to choose from.

- Contributions vary per state, but limits can run as high as $300,000 per account.

- Beneficiaries can be named in multiple accounts.

- Parents, grandparents, and friends can all contribute to the account.

- Beginning in 2018, up to $10,000 per year can be used for K-12 education expenses.

- No age limit for starting an account or distributing from an account.

- No income limits for contributing to the account.

Cons:

- Less investment flexibility due to investment tracks (investments can only be changed once a year).

- Some plans have higher than average fees that affect investment return.

IMPORTANT:

Considering a college savings account requires quite a bit of strategy regarding taxes, investments, generational wealth transfer, financial aid, and other areas of financial planning. There are a lot of rules regarding these two account types that are not discussed in the above synopsis. It is very important that you meet with a qualified financial planner to make sure you are maximizing the potential benefit.

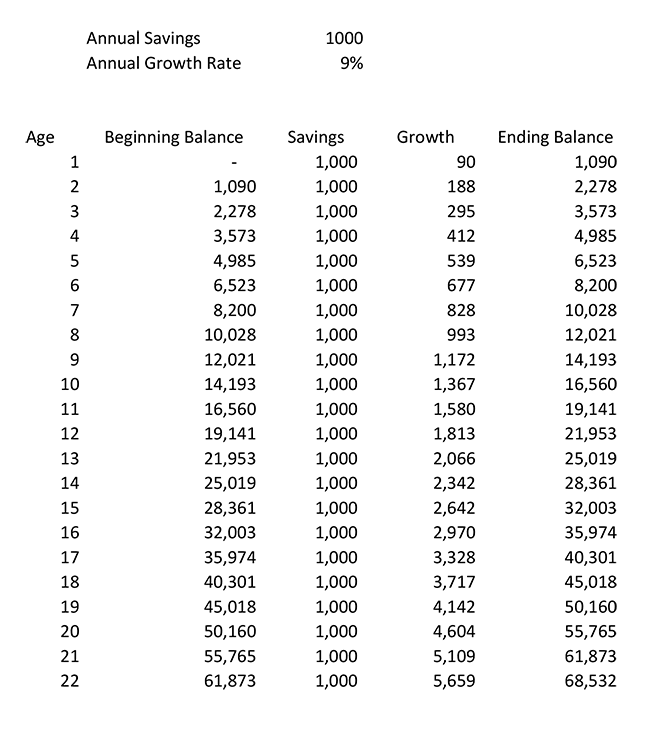

Table 1

This table illustrates a college savings plan of $1,000 per year in either an ESA or a 529 Plan.

Sources:

savingforcollege.com, nitrocollege.com & daveramsey.com