Market Commentary Q2 2025

The second quarter of 2025 brought a mix of challenges and opportunities for investors. Global markets navigated significant volatility, driven by U.S. trade policy shifts, geopolitical tensions, and evolving economic signals. Despite a sharp selloff in April due to new tariff announcements, markets rebounded strongly, with most major indices posting positive returns by quarter-end. This resilience in the market emphasizes the importance of staying focused on investing for the long-term, a foundation of our investment philosophy at Petersen Hastings.

Quarterly Recap

The U.S. economy showed strength despite a bumpy start to the year. After a slight decline in Q1 activity, Q2 Gross Domestic Product (GDP) estimates ranged from increases of 1.7% to 4.6%, fueled by strong consumer spending and business investment. Inflation continued to cool, approaching the Federal Reserve’s 2% target, though tariff concerns raised caution about future price pressures. The labor market remained solid, with unemployment at 4.1% and real wage growth outpacing inflation.

Despite a sharp decline to the S&P 500 in April, the market roared back to new historic highs rapidly, marking one of the fastest recoveries ever. In Q2 alone, the S&P 500 rose nearly 11%, while the Nasdaq Composite surged around 17% – its best quarterly gain since 2020. For the year through the end of June, both indexes posted net gains north of 6%.

Growth and technology stocks once again led the charge in Q2, powering much of the market’s strong performance. Despite factors like rising long-term interest rates, geopolitical risks in the Middle East, and continued uncertainty around tariffs, taxes, and federal spending, investors appeared less reactive to headlines – a notable shift from past market behavior.

Market Summary

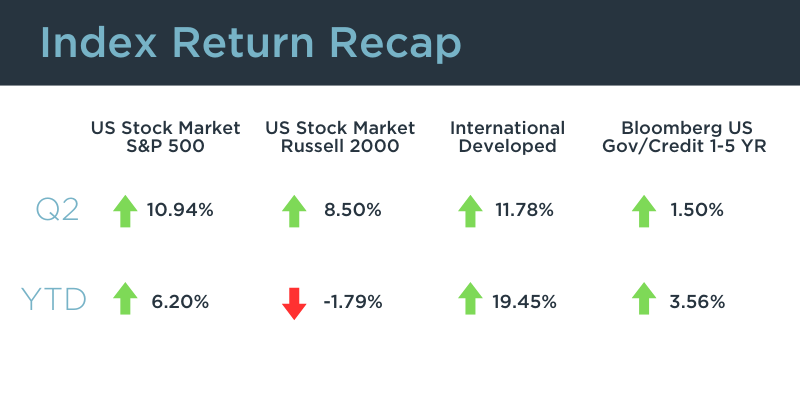

Quarter 2 (April 1, 2025 – June 30, 2025) & Year-to-Date 2025 Index Returns

Looking Ahead: Themes & Takeaways

As we move into the second half of 2025, several themes may shape the investment landscape:

- Trade Policy Uncertainty: Ongoing U.S. tariff negotiations, particularly with China, could possibly bring short-term volatility.

- Geopolitical Instability: Tensions in the Middle East eased by quarter-end, but potential risks remain. Diversified portfolios help mitigate headline-driven volatility.

- Technology and Innovation: Mega-cap tech stocks, fueled by AI advancements, may continue to power much of the market’s gain.

Looking ahead, markets may face challenges from trade policy outcomes, potential economic slowdowns, and Federal Reserve decisions. The Fed signaled two possible rate cuts in 2025 but emphasized caution due to inflation risks. While short-term fluctuations are inevitable, resilient corporate earnings, a strong labor market, and cooling inflation provide a solid foundation for growth.

At Petersen Hastings, our investment philosophy remains steadfast: we focus on the long-term, building diversified portfolios aligned with your unique goals. We don’t chase market trends or react to daily noise. Instead, we prioritize disciplined strategies that weather volatility and deliver sustainable results.

Our Commitment to You

Thank you for trusting Petersen Hastings Wealth Advisors to guide your financial journey. Our mission is to help you discover where you’re most invested in life – family, community, or personal passions – and build the financial freedom to live it fully. We’re here to answer your questions, review your portfolio, or discuss how we can further align your investments with your aspirations. If you have a loved one that may be in need of our expertise and guidance, we would value the introduction. We thank you for your continued trust.