Market Commentary Q3 2025

As summer came to a close, investors were reminded once again that patience pays off. What began as a cautious quarter, ended with markets breaking new records and renewed confidence in the economy’s strength. The S&P 500 closed above 6,600 for the first time, gaining over 5% during the quarter and pushing year-to-date returns into double digits. The Dow Jones Industrial Average surpassed 46,000, and even small-cap stocks joined the rally with strong performance. It’s a timely reminder that patience, discipline, and diversification remain instrumental in achieving long-term success, a cornerstone of our philosophy at Petersen Hastings Wealth Advisors.

Quarterly Recap

After months of anticipation, the Federal Reserve lowered interest rates in September for the first time since late 2024. The quarter-point cut brought rates to around 4%, a move aimed at supporting the economy as hiring and growth show early signs of slowing. Fed Chair Jerome Powell described the decision as a way to “manage risks” and keep the economy on a steady path.

Strong corporate earnings added to the positive momentum. About 8 in 10 large U.S. companies reported better-than-expected results, marking one of the strongest earnings seasons in recent years. Continued growth in technology and artificial intelligence, along with steady consumer spending and improving global trade, all played a role.

Inflation also showed encouraging signs. Core prices, which exclude food and energy, rose 3.1% over the past year, a slower pace than earlier in 2025. Combined with the Fed’s rate cut, this gave investors more confidence that economic conditions may remain stable heading into year-end.

Market Summary

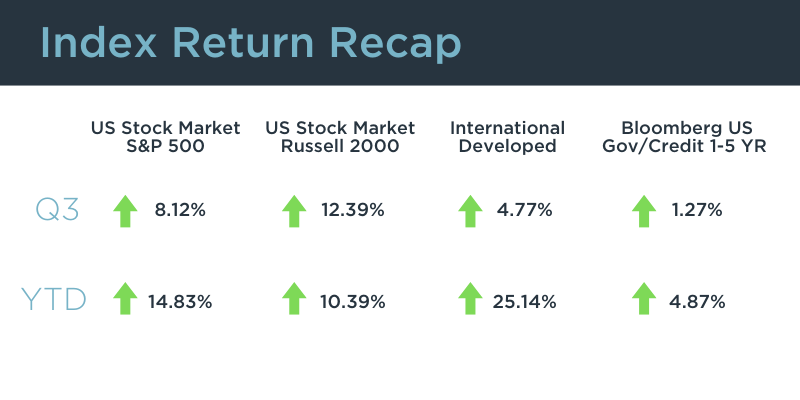

Quarter 3 (July 1, 2025 – September 30, 2025) & Year-to-Date 2025 Index Returns

Looking Ahead: Themes & Takeaways

As we move into the final quarter of 2025, several key themes may influence the investment landscape:

- Federal Reserve Policy: Markets anticipate the possibility of another small rate cut by year-end if labor trends soften further. A move that could help support equity and fixed-income returns.

- Economic Growth: Growth is expected to cool slightly, but resilient consumer spending and solid corporate earnings continue to support the outlook for a soft landing.

- Trade Developments: Ongoing U.S. negotiations with key partners, including China, Japan, and the European Union, may continue to shape global supply chains and investor sentiment.

- Investor Behavior: The year’s rapid rebound serves as a reminder that emotional investing can hurt long-term returns. Those who stayed the course through April’s volatility participated in one of the fastest recoveries in modern market history.

Our Commitment to You

At Petersen Hastings Wealth Advisors, our focus remains on helping you invest with purpose and confidence. We understand that behind every portfolio is a set of deeply personal goals, from family legacies to community impact. While short-term market fluctuations will always be part of the journey, staying committed to a disciplined, diversified strategy has consistently rewarded patient investors.

Thank you for entrusting us to guide your financial journey. If you’d like to review your portfolio, discuss market developments, or explore how recent changes may affect your plan, our team is here to help. As always, we appreciate your continued trust and referrals for those you care about.