Trump Accounts for Kids: What Parents Need to Know

Saving for a child’s future is about to get a new option. Starting July 5, 2026, Trump Accounts will join other ways to save for children like 529 plans, UGMA/UTMA accounts, and custodial Roth IRAs. But they come with unique rules and benefits. If you’re wondering what Trump Accounts are, who qualifies, and how they work, here’s what is known so far, with more details still to come.

What is a Trump Account?

Trump Accounts are a type of IRA for minors which allows for tax-deferred investments. In short, a child-focused IRA that’s designed to encourage early savings for retirement. The assets are owned by the child, while an adult, typically a parent or guardian, is authorized to act on the child’s behalf until the beneficiary reaches age 18.

Who is Eligible?

Children under age 18 with a Social Security number are eligible for Trump Accounts. The Treasury’s pilot program adds a one-time $1,000 seed contribution for US citizens born between January 1, 2025, and December 31, 2028, when a tax election is filed on the child’s behalf. Only one funded Trump Account is allowed per child.

Children who aren’t eligible for the seed contribution can also get a Trump Account, they just won’t receive the $1,000 contribution. Families may still find good reasons to consider it.

How Do I Open a Trump Account for My Child?

Opening a Trump Account starts with an election process through the IRS, either by filing Form 4547 or using the online tool at trumpaccounts.gov. Elections are scheduled for mid-2026, with accounts becoming available July 5, 2026. Once the election is complete, the Treasury will provide instructions to activate the account.

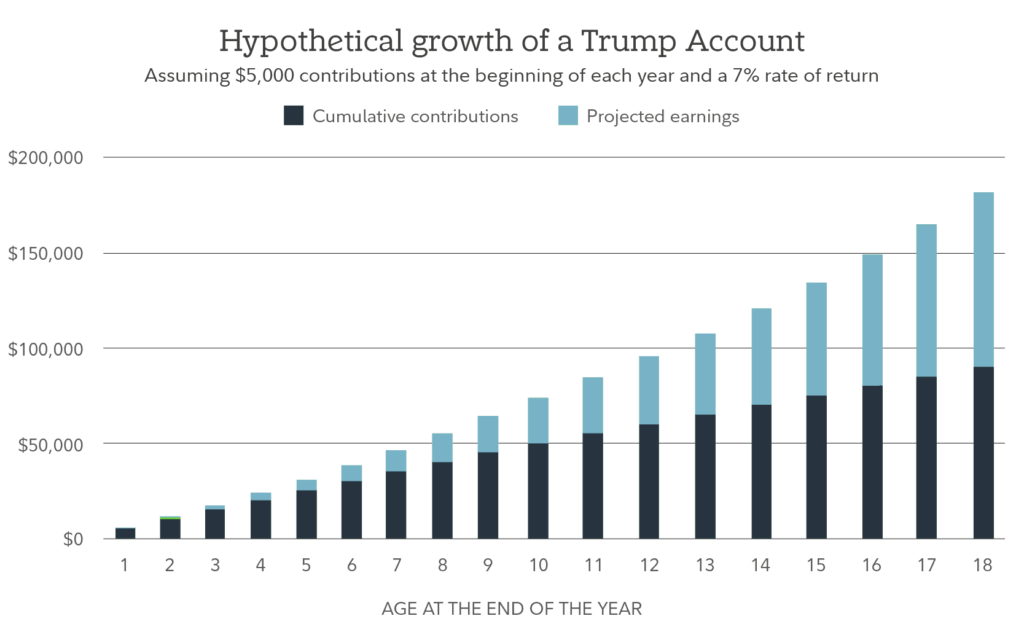

This hypothetical example assumes the following: (1) annual contributions of $5,000 on January 1 of each year for ages 1 through 18, with no withdrawals through age 18, (2) an annual nominal rate of return of 7%, and (3) no taxes on any earnings within the account. The ending values do not reflect taxes, fees, or inflation. If they did, amounts would be lower. Earnings and pre-tax contributions from Trump Accounts are subject to taxes when withdrawn. Distributions before age 59½ may also be subject to a 10% penalty. Systematic investing does not ensure a profit and does not protect against loss in a declining market.

This example is for illustrative purposes only and does not represent the performance of any security. Consider your current and anticipated investment horizon when making an investment decision, as the illustration may not reflect this. The assumed rate of return used in this example is not guaranteed. Investments that have potential for a 7% annual nominal rate of return also come with risk of loss.

Who Can Make Contributions?

Several sources can fund a Trump Account, making it flexible for families. Contributions can come from individuals, employers, and even charitable organizations. Each source has its own rules and tax treatment, so it’s important to understand how they work.

How Much Can You Contribute to a Trump Account?

The total that can be contributed to a Trump Account is $5,000 per year. Multiple sources can contribute each year. Contribution limits apply across all sources combined with one exception: The government seed amount and qualified general contributions (i.e., from charitable organizations) don’t count toward the annual limit, which can make a big difference for eligible families.

- Government seed (pilot): A one-time $1,000 contribution for eligible newborns (Born between January 1, 2025 and December 31, 2028); it does not count toward annual limits. This one-time contribution plus any other qualified general contributions will be taxable when withdrawn.

- Individual contributions: Any adult can contribute, up to a combined total of $5,000 per year for the account. There’s no earned income requirement for the child. These contributions are made on an after-tax basis and are not taxable when withdrawn.

- Employer contributions and employee deferrals: A unique feature of the Trump Account is that it can be funded by both your employer and/or by you through a pre-tax payroll deduction option, similar to other benefit elections. As with other benefits, not every employer or plan may offer this feature.

How Are Investments Handled?

Investment options for Trump Accounts are intentionally straightforward:

- Mutual Funds or ETFs that track the S&P 500 or another equity index for which regulated futures contracts are traded, with at least 90% invested in US companies.

- No leverage is allowed in the investments, meaning borrowed funds cannot be used to purchase securities.

- Expense Ratio Cap: 0.10% (10 basis points) or less.

- Trustees may offer multiple options and must designate a default investment. Families can allocate across the menu within the constraints above.

This design aims to promote long-term, broad market exposure with very low costs and minimal complexity.

How Do Distributions Work?

Once the beneficiary reaches age 18, Trump accounts are treated like traditional IRAs for tax purposes. Distributions are generally taxable as income and early withdrawal penalties can apply. Distributions are prohibited until age 18, except for a rollover or the death of the beneficiary.

Most contributions will result in “basis” and can be distributed tax free. This is because no tax deduction is allowed on contributions so these can later be withdrawn without tax. Government contributions, employer contributions and growth, however, will be taxed.

How Do These Accounts Compare to a 529 Account?

529 accounts would be a preferable form to save for higher education given that distributions, if used for qualified expenses, would not be subject to income tax at all. Trump account distributions, if used for college, would be subject to income tax, even if they could be used penalty-free for college after age 18.

How Do These Accounts Compare to a UTMA Account?

UTMAs do not necessarily grow tax free, which is a disadvantage compared to Trump accounts. During growth, dividends, interest, capital gain distributions, as well as gain from any investment changes would be taxable. However, UTMAs would have capital gain treatment on sale at distribution rather than the ordinary treatment of Trump account income. Depending on the beneficiary’s tax situation this may be preferable.

UTMAs would also not be subject to penalty if the funds need to be used for purposes like a vehicle purchase or wedding. Distributions from a Trump account for these uses would be subject to tax AND penalties.

Summary of Trump Account Features

Benefits of Trump Accounts

- Tax-deferred growth potential.

- No earned income requirement for contributions.

- $1,000 government seed contribution for eligible newborns.

- Low-cost index fund/ETF investment options.

- Flexible funding sources.

What to Consider

- Limited investment menu.

- No withdrawals before age 18.

- Annual contribution cap of $5,000 per child.

- Distribution will be taxed as income at child’s tax rate.

- Employer payroll feature depends on plan adoption.

The Bottom Line on Trump Accounts

Trump Accounts could offer families a straightforward, low-cost path to begin investing for a child’s future, with strict no-withdrawal rules before age 18 and traditional IRA rules thereafter. If you have a child that fits the date range or are planning for a child, speak with a Petersen Hastings Wealth Advisor or visit trumpaccounts.gov for the most up-to-date information. Coordinating with your education, retirement, and tax strategies can help you make the most of this new account and ensure fluidity with your family’s broader financial plan.